The Cybersecurity Hack That’s as Easy as Coffee: Why You Should Use a Prepaid Debit Card for Online Safety

Because, Cybersecurity Awareness Month is EVERY MONTH!

The Cybersecurity Hack That’s as Easy as Coffee: Why You Should Use a Prepaid Debit Card for Online Safety

Convenience often trumps caution, until it doesn’t. Data breaches are becoming a frequent headline, and personal financial information is one of the most targeted assets. So how can you protect yourself without having to become a cybersecurity expert? Enter one of the simplest and most effective strategies: using a prepaid debit card for online transactions. It’s a low-tech solution with a high impact on your financial security.

Why a Prepaid Debit Card?

A prepaid debit card works as a stand-in for your actual debit or credit card. Here’s how it enhances your cybersecurity game:

- Minimal Exposure: By loading only a small amount- say, $5, and spending all but a cent, you minimize the value of the card to potential hackers. If a company’s database is compromised, cybercriminals gain access to essentially nothing.

- One-Time Use: For companies that require a card on file but don’t actively use it for ongoing payments, a prepaid debit card serves as a disposable placeholder, protecting your primary accounts.

- Reduced Fraud Risks: Prepaid cards separate your main financial accounts from online purchases, reducing the risk of fraudulent charges on your primary accounts.

Virtual Debit Cards: An Alternative Option

Previously, many banks offered virtual debit cards, temporary, digital-only cards linked to your main account. These were highly effective for secure online purchases. However, with many banks discontinuing this service, prepaid debit cards have emerged as a robust and accessible alternative.

Step-by-Step Guide to Using a Prepaid Debit Card for Online Transactions

- Purchase a Prepaid Card: Choose a card with a minimal initial balance.

- Load It Strategically: Load just enough to cover your anticipated purchase(s).

- Use It Online: Enter the prepaid card details during checkout or when setting up an online subscription.

- Monitor the Balance: Keep track of the remaining balance, but aim to leave just a few cents to devalue the card for future breaches.

- Repeat: Use new prepaid cards as needed to maintain maximum security.

Additional Cybersecurity Tips for Online Financial Safety

- Secure your accounts with 2FA wherever possible for an extra layer of protection.

- Avoid saving your card details on websites unless absolutely necessary.

- Be cautious of emails and links that could lead to malicious sites or fake payment gateways.

- Even with prepaid cards, vigilance is key to spotting unauthorized charges.

The Broader Context: Embracing Cyber Core Values

At Big Sky Quantum SHIELD, we champion actionable steps like these to promote cybersecurity for everyone. Using a prepaid debit card aligns with core values like vigilance, prudent sharing, and responsibility, which are crucial for maintaining digital safety. It’s these small but impactful changes that empower individuals and protect communities in the quantum age.

Cybersecurity doesn’t have to be complicated. By incorporating practical tools like prepaid debit cards into your routine, you can significantly reduce your exposure to financial risks. Remember: the best defenses are often the simplest. Share this tip with your network and encourage others to adopt better digital hygiene.

Let’s protect our digital lives, one small step at a time. Want to dive deeper into creating a safer digital world? Check out our Rollin’ Cyber Initiative, a mobile cybersecurity education project bringing hands-on lessons to communities nationwide.

Stay safe and STAY VIGILANT!

Big Sky Quantum SHIELD - GLOSSARY

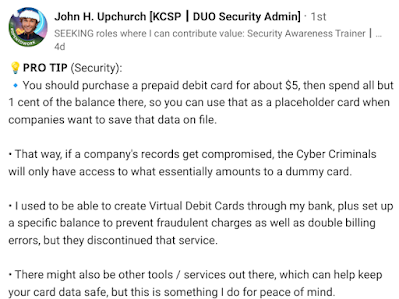

This blog was inspired by the following post!

.jpg)

Comments

Post a Comment